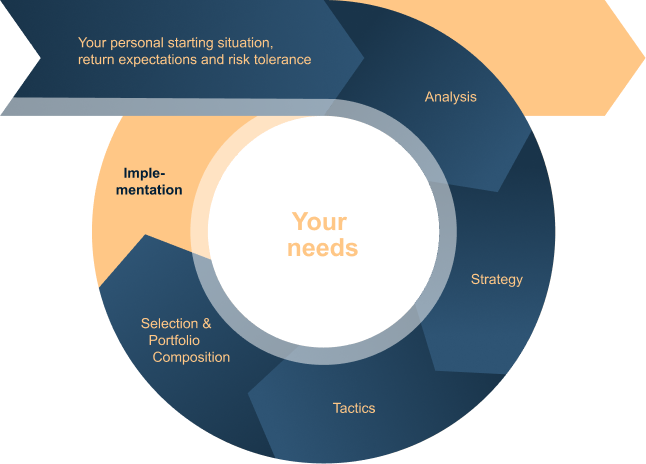

Investment concept & investment approach

Our goal is to generate additional income through active wealth management.

Benefit from the advantages of diversified wealth management

The strategic asset structure is an essential prerequisite for long-term investment success. We know that individual investment areas (e.g. stocks, bonds, gold) do not develop uniformly over time. If they are optimally combined, the risk is lower than when investing in a single asset class. The weighting of the asset classes is determined by your investment objectives and your investment mentality. For tactical implementation, asset management may invest beyond the agreed, strategic quotas within defined bandwidths. The basis for this is the permanent analysis of the global financial markets by our investment team.

The investment universe

-

EquitiesThe share certifies a part of the capital stock of a stock corporation. The holder of a share is thus a co-owner of the corporation and participates directly in its economic success.

-

GoldGold is a precious metal. These are metals with special physical properties. They are characterized by their high stability of value, because they are rare and must be extracted at great expense.

-

BondsBonds or loans are securities that securitize debt capital. The owner of a bond is a creditor and is entitled to interest and repayment from the debtor (issuer).

-

Risk-adjusted investmentsAs a rule, risk-adjusted investments are implemented by means of individual certificates, such as discount certificates, bonus certificates and reverse convertibles.

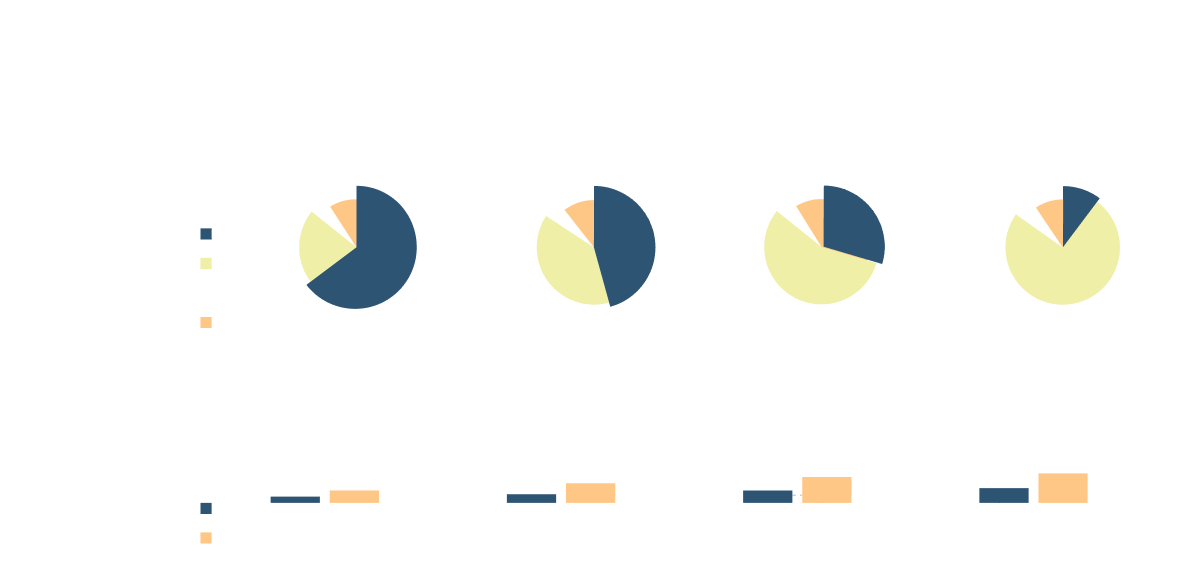

Exemplary strategies

Our systematic investment process, which focuses on your investment objectives, is the prerequisite for lasting investment success. We determine a suitable strategic asset structure tailored to your investment profile. Based on this, we create an investment proposal for you.

Within the asset classes, we only consider securities that have undergone our research process and are attractively valued from a fundamental point of view.

Exemplary strategies

In the following we present exemplary investment strategies for certain investment objectives. The investment objectives result in minimum return targets or maximum loss limits for the investment strategy. These determine the strategic asset structure and the maximum portfolio proportions of risky asset classes such as equities.

Active risk management

In times of uncertainty on the markets, professional risk management plays an increasingly important role. It is important to determine, limit or exclude the individual risk perception between you and us as wealth managers. We try to minimize the potential risks through an appropriate asset allocation and generally the selection of undervalued assets. In addition, quantitative risk measurement provides continuous support in assessing the capital market situation and, if necessary, preventing undesirable scenarios by acting quickly.

FAQ

-

How can I reset my password?

To reset your password, follow these easy steps:

If you know your password and simply want to change it, then log in and go to the ‘My Account’ section. There is an option there to change your password.

If you are unable to log in, then select the ‘login’ button at the top of the page and just below the login fields, you will see an option that says, ‘Forgot My Password’. Click on this link, enter your account email address, and submit. You will receive an email shortly with further instructions on how to reset your password. -

Is it possible to change the base currency for my account?

Once your account is opened, the base currency cannot be changed. To have your account in another currency, please contact support and they will assist you in creating a new account with the desired base currency. -

How do I increase my leverage?

If you wish to increase your available leverage, please contact our support. However, be aware that you will need to meet certain requirements to qualify for higher levels of leverage. -

Where do I update my personal information?

Simply log in and visit the ‘My Account’ section. From there, you will be able to edit certain profile fields. To change your email or default currency, you will need to contact support. -

Which account type should I choose?

We have various account types to match your trading needs and style, and how much capital you plan to trade with. Please look at the Account Types page to learn more and if you still have questions, support will be more than happy to assist.

-

How do I change my account type?

Please check that you meet the requirements for the type of account you want to change to. You can find all the relevant information on the Account Types page. If you meet the requirements, please contact support and they will make the change for you. -

Can I use my spouse’s trading account?

We will need written consent from your spouse confirming that they are allowing you to use their account. Please send this confirmation to [email protected] -

What is account verification and why must I do it?

As a financial services organization we are obligated to abide by KYC (Know Your Customer), anti-money laundering regulations and various other processes. KYC requires confirming the identity, residential address, and payment method of all clients. The account verification process is also to protect your account from any unauthorized use. The process is quick and easy. We highly recommend completing the verification as soon as you open your account to get it out of the way and allow you to focus on your trading.

-

What documents are needed for account verification?

ou will need to upload the following documents and please ensure the images are clear and legible:

• Proof of Identity – A colour photo or scan of your valid government-issued ID, driver’s license, or passport.

• Proof of Address – A photo or scan of a utility bill or bank statement that is no more than 3 months old. It must show your full name and residential address.

• Proof of Payment Method – If you are using a debit or credit card to fund your account, please send a photo or scan of the front and back of the card showing your name, expiry date, and partial card number. Please cover the middle 8 digits for security purposes, so only the first and last 4 digits are visible.

Organizational Structure

-

Niklaus DiederichChief Executive Officer

Niklaus DiederichChief Executive Officer -

Hendrik HelmuthChief Market Officer Private & Corporate Banking

Hendrik HelmuthChief Market Officer Private & Corporate Banking -

Caroline NadineChief Market Officer Asset Servicing & Digital Assets

Caroline NadineChief Market Officer Asset Servicing & Digital Assets

Contact Us

Our support teams are here to assist you for any question or requests you might have.